Unlock $30+ Daily with This Time-Tested MS Strategy!

Turn Spare Time Into Profit: A Simple MS Hack for Consistent Returns

While MS (Manufactured Spending) strategies have evolved, some classic methods still work perfectly in 2024. If you’ve got extra time on your hands or are looking for more stable opportunities, here’s a gem: a CVS-based MS approach that combines multiple platforms to maximize rewards. This method leverages Visa Gift Card (VGC) purchases and in-store offers for quadruple rewards, creating impressive returns with minimal effort.

Step-by-Step Strategy

1. Purchase VGC at CVS

Start by purchasing a $500 VGC at CVS. Note the $5.95 fee per card when calculating costs.

CVS allows up to $2,000 worth of VGC purchases every 24 hours. These transactions must be completed at the counter with ID verification.

2. Use Your Credit Card for Cashback

Choose a card that gives extra cashback at drugstores or use this for meeting sign-up bonuses.

Example cards:

Amex Blue Cash Preferred for 6% cashback at drugstores.

Cards with spend bonuses to meet minimum spend requirements for sign-up rewards.

3. Ibotta In-Store Offer: 4% Cashback (Up to $100/24 Hours)

Why Ibotta? Ibotta currently offers a 4% cashback reward for CVS purchases, capped at $100 every 24 hours. This means purchasing a $500 VGC can earn $20 cashback.

How to Use:

Link your CVS account to Ibotta.

At checkout, scan your CVS card so Ibotta can automatically track your purchase.

Add the offer in the Ibotta app before each purchase. The offer resets after 24 hours.

Redeem cashback once it reaches $20, which can be withdrawn to a bank account or PayPal.

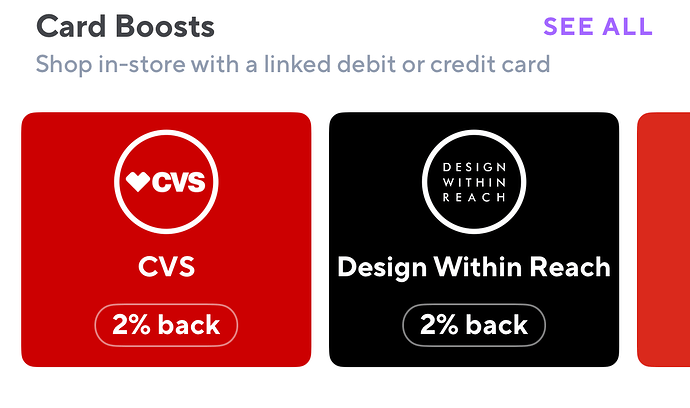

4. Lolli Rewards: 2% Cashback (Up to $6/Day)

What is Lolli? Lolli is a cashback app that tracks purchases made with linked credit cards. It offers 2% cashback on CVS purchases, up to $6 daily.

How to Use:

Link your credit card in the Lolli app.

Activate the "Card Boost" feature in the app before making a purchase (must be done daily).

Cashback is confirmed in about 5 days and can be withdrawn via Bitcoin or a bank account.

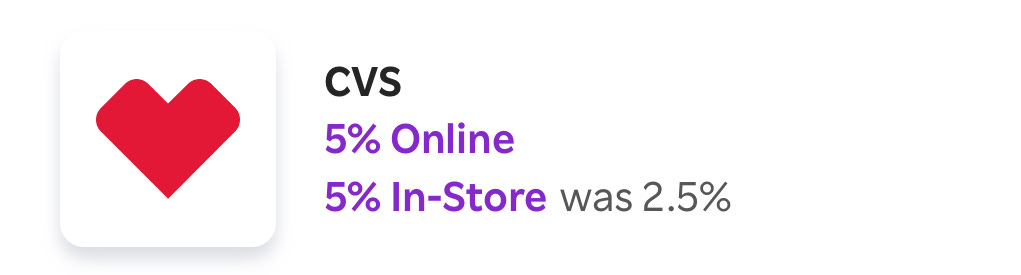

5. Rakuten In-Store Offer: 5% Cashback (Up to $5/Transaction)

Why Rakuten? Rakuten provides 5% in-store cashback on CVS purchases, with a cap of $5 per transaction. Unlike other platforms, Rakuten supports multiple transactions per day, provided the offer is activated.

How to Use:

Link your credit card to Rakuten for tracking.

Activate the in-store offer in the app before each transaction (valid for 1 hour).

Cashback will post after the transaction and can be redeemed as PayPal cash or a check.

Tips for Success

CVS-Specific Risks:

Non-rural CVS stores are hotspots for VGC fraud. Always ask the cashier to open the VGC packaging and verify the card's security during checkout.

Liquidate VGC balances quickly to minimize risks.

Platform Rules:

Respect each platform's daily and transaction limits:

Ibotta: One offer every 24 hours.

Lolli: Maximum $6 cashback daily.

Rakuten: $5 per transaction with no daily cap (as long as offers are activated).

Avoid Suspicious Activity:

Spread your transactions over time and avoid large, repetitive spending patterns to prevent triggering credit card account reviews or freezes.

Example of Quadruple Rewards

Buying a $500 VGC at CVS under this strategy could yield:

Credit Card Cashback: Variable (depends on your card, e.g., 5–6% for drugstores).

Ibotta: $20 cashback.

Lolli: $6 cashback.

Rakuten: $5 cashback.

Total Reward: ~$31 per $500 VGC (plus credit card rewards).

Final Thoughts

This CVS-based MS method is ideal for those with extra time and flexibility. While it involves multiple steps, the combined cashback can add up quickly, making it worth the effort. Just remember to follow the tips for minimizing risks and keeping your transactions smooth.

If you’ve got other strategies or better tips, drop them in the comments below! Let’s keep optimizing. 🚀

To me, I am new to this but that seems like an amazing play. Well thought out. Chess moves. Since this is MS and we are getting the points for SUBS, etc and we are earning cash back for spend, how are we MS the initial VGC amount of $500? How am I paying back the AMEX? Or is it organic spend? Thanks for the article.

Shouldnt the total cost calculation include the $5.95 gift card fee? So it would be:

Total Reward: $25.05 ($31 per $500 VGC plus credit card rewards less $5.95 fee).